20+ In Home Daycare Tax Deduction Worksheet

If the condemned property was your main home subtract from this total the gain you excluded from your income and enter the result _____ 20. Web Add lines 17 and 18.

43 Stay At Home Mom Jobs No Mlms Or Surveys Stay At Home Bride

Line 21Student Loan Interest Deduction.

. Web The specific withholding or deduction requirements or other appropriate requirements to be used to collect the support be set forth in and determined by reference to the notices that are mailed by the Court or Child Support Enforcement Agency in accordance with Divisions A2 and D of Section 311321 of the Revised Code or Court. Web Instructions for the Daycare Facility Worksheet Use this worksheet to figure the percentage to use on line 3b of the Simplified Method Worksheet. Establish that during 2021 you had a tax home in a foreign country and.

He maintains his own household and provides more than half of the cost of maintaining that home for him and Nicole. Monthly Essential Living Expenses Maximum Rent 35 of take-home -540 Utilities 20 of rent electric water trash internet -108 Car loan or lease payment Car Insurance -116 Gas -50 Public transportation monthly pass est. 587 Business Use of Your Home Including Use by Daycare Providers.

Microsoft describes the CMAs concerns as misplaced and says that. Revenue Procedure 2021-20 has allowed for a safe harbor for certain taxpayers who did not deduct certain otherwise deductible expenses paid or incurred during the tax year ending after March 26 2020 and on or before December 31. We welcome your comments about this publication and suggestions for future editions.

Must have your main home in one of the 50 states or the District of Columbia for more than half of the tax year. Business Use of Your Home Including Use by Day-Care Providers. Join the discussion about your favorite team.

See the worksheet on page 25 of IRS Publication 587 for the rest of the calculation. 7 Part II Figure Your Allowable Deduction. If you use either optional method to figure self-employment tax subtract any.

You may have to do a few more calculations to get the total deduction amount. 503 to the Instructions for Form 2441. Web Advance Child Tax Credit.

All others enter the amount from line 3. She has spent over 20 years working in both public and private schools. Web You use part of your home as a daycare facility.

With our money back guarantee our customers have the right to request and get a refund at any stage of their order in case something goes wrong. Web Microsoft pleaded for its deal on the day of the Phase 2 decision last month but now the gloves are well and truly off. You do not have to save receipts as there is a standard meal rate available.

If less than zero enter -0. Enter the total cost of replacement property and any expenses to restore the usefulness of your remaining property _____ 21. Generally you cant deduct any expenses for travel away from your tax home for any period of temporary employment of more than 1 year.

Section 210 of the Taxpayer Certainty and Disaster Tax Relief Act of 2020 provides for the temporary allowance of a 100 business meal deduction for food or beverages provided by a restaurant and paid or incurred after December 31 2020 and before January 1 2023. The Sales Tax Deduction Calculator IRS. For an explanation of these exceptions see Pub.

Web 100 money-back guarantee. A checklist of tax write-offs that all child care providers should know about. You have an average monthly allowable square footage of 125 square feet 300 square feet for each month August through December divided by the number of months in the taxable year 300.

For daycare facilities not used exclusively for business multiply line 6 by line 3 enter the result as a percentage. Web We moved Worksheet A Worksheet for 2020 Expenses Paid in 2021 from Pub. Web The federal tax code allows home businesses to take a tax deduction for a specific space in the home where they do business.

Your main home can be any location where you regularly live. Enter the amount from Schedule C line 29 plus. If you do not use the area of your home exclusively for daycare you must reduce the prescribed rate before figuring your deduction using the simplified method.

See Cash contributions for individuals who do not itemize deductions later. Web Credit for prior years expenses and worksheet for 2020 expenses paid in 2021. For more details on the definition of a tax home see Pub.

A document published by the Internal Revenue Service IRS that provides information on how taxpayers who use. Web Deduction for qualified business income. Web IRS Publication 587.

If they must use the Standard Deduction Worksheet for DependentsLine 12a in the Instructions for Form 1040 they should enter the amount. Or for a daycare facility. Subtract line 20 from line 19.

This is a MAJOR deduction. NW IR-6526 Washington DC 20224. Any gain derived from the business use of your home.

Form 1040 or are a partner you should use the Worksheet To Figure the Deduction for Business Use of Your Home in Pub. However if you elect to use the simplified. 340100 20 of business income from qualified trade or business including specified services or businesses.

Web Line 20IRA Deduction. For tax years beginning after 2017 you may be entitled to take a deduction of up to 20 of your qualified business income from your qualified trade or business plus 20 of the aggregate amount of qualified real estate investment trust REIT and qualified publicly traded partnership income. Web Following a bumpy launch week that saw frequent server trouble and bloated player queues Blizzard has announced that over 25 million Overwatch 2 players have logged on in its first 10 daysSinc.

Web Comments and suggestions. Taxable income in range has prorated deduction. Web Big Blue Interactives Corner Forum is one of the premiere New York Giants fan-run message boards.

Dean pays a daycare provider to care for Nicole to allow him to work. Web For example you begin using 400 square feet of your home for a qualified business use on July 20 and continue that use until the end of the taxable year. Web Temporary Allowance of 100 Business Meal Deduction.

Web 20 of business income from qualified trades or businesses including Specified Service Trade or Business SSTBes. Web If you dont itemize your deductions on Schedule A Form 1040 you may qualify to take a deduction for contributions of up to 600. Web As an itinerant you are never away from home and cant claim a travel expense deduction.

Web The big list of home daycare tax deductions for family child care businesses. Web If you paid 3000 of mortgage insurance premiums on loans used to buy build or substantially improve the home in which you conducted business but the Mortgage Insurance Premiums Deduction Worksheet you completed for the Worksheet To Figure the Deduction for Business Use of Your Home limits the amount of mortgage. Web First Apartment Budgeting Worksheet Your Budget Monthly take-home pay 1360.

You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave.

Office Depot

Child Profile Card Printable Pdf Document For Download Starting A Daycare Daycare Forms Opening A Daycare

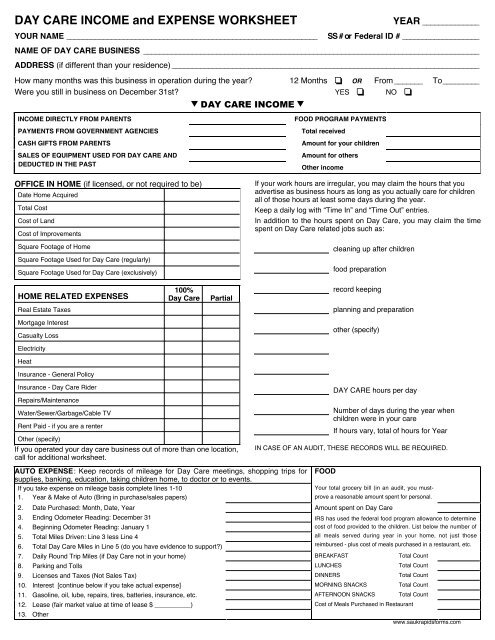

Day Care Income And Expense Worksheet Mer Tax

Can I Deduct My Home Office Expenses If I Work From Home But Am A Fte That Receives A W 2 Or Is That An Irs Red Flag Quora

Daily Attendance Report Template Free Report Templates Report Template Attendance Sheet Template Attendance Sheet

Taxes For In Home Daycare Little Sprouts Learning

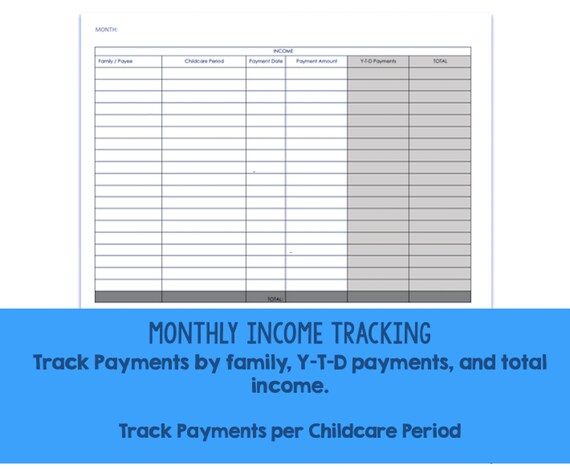

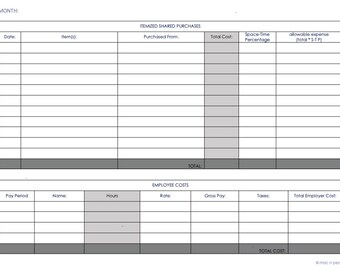

Home Daycare Monthly Budget Worksheet Tax Preparation Etsy

Suffolk Library Consultation Summary Pdf Public Library Libraries

In Black White

Covid 19 Resources 4cs Of San Mateo County

Home Daycare Monthly Budget Worksheet Tax Preparation Etsy

Coronavirus Updates Unity Health Care

Taxes For In Home Daycare Little Sprouts Learning

Mileage Logs Forms Checklists For Child Care Providers

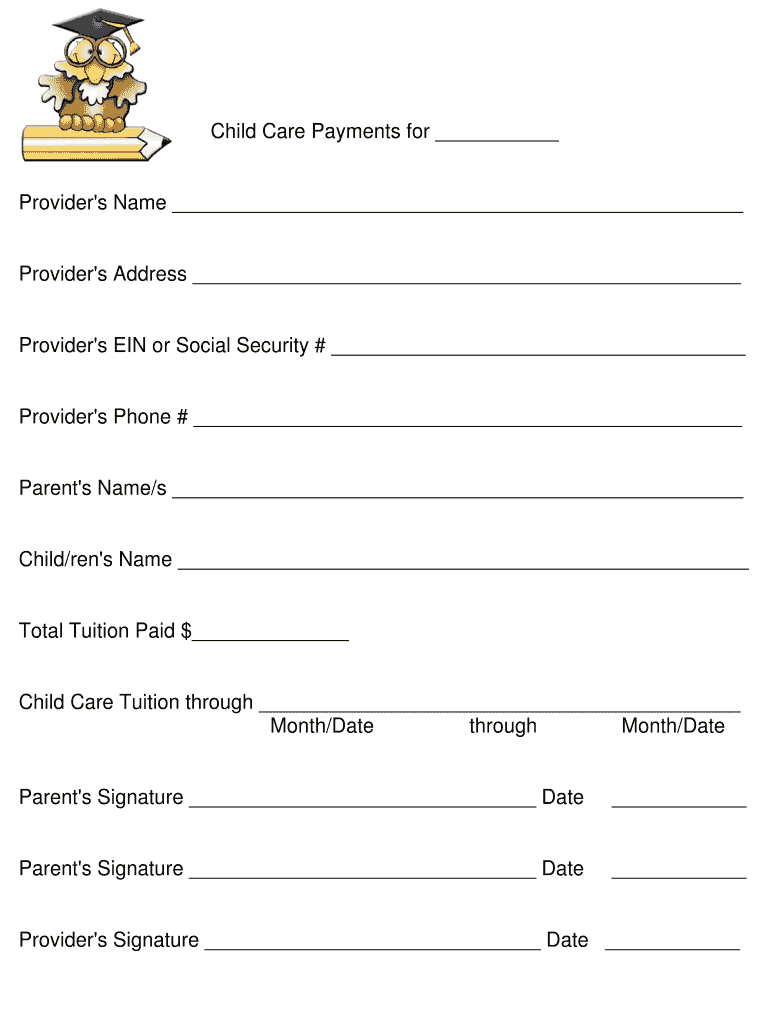

Form For Daycare Tax Fill Online Printable Fillable Blank Pdffiller

The Big List Of Common Tax Deductions For Home Daycare Family Child Care Home Daycare Childcare Business

Daycare Enrollment Forms All Editable Contract Enrollment Etsy Canada